Money Management YouTube Series

Many Americans often find themselves broke and living paycheck to paycheck. But why does this happen? Is it because of lack of income/earnings? Is it due to not having certain “higher” level education or degrees like a Bachelor’s or Master’s degree from college? Is it because of certain race, gender, sexual preference or other items which can be discriminated against? Contrary to popular belief, it’s NOT just tied to how much money a person makes.

George Floyd’s Impact, Inspiration and Legacy

In early 2020, because of the tragic murder and death of George Floyd, Americans were forced to confront some realities that some would rather not. His death, on top of many Americans being out of work due to the Covid-19 Pandemic, was just enough to push us into a tailspin of social unrest. The resulting looting, rioting and “every person for themselves” mentality which followed, made one thing clear (if it was to no one other than ourselves). Through no fault of their own, many Americans are only one paycheck away from disaster.

This can be a small disaster like missing a cell phone bill, a cable bill or not having enough to go out and eat at your favorite restaurant. Or it could be a serious disaster like missing a rent or mortgage payment, getting evicted, or having to turn to a food pantry for help.

Our good friend, and client, Ashanti Johnson over at 360 Mind Body Soul here in Chicago, encouraged us to start a video series in connection with a virtual wellness summit that our CEO, Jared Rogers, participated in. Check out this specific point in Episode 10 where Jared shares a snippet of her summit and talks about George Floyd and the resulting motivation to launch the series.

In the end, seeing as we deal with money on a day-in and day-out basis, it only made sense that we should work to share the knowledge we have built up over the years with those who need it the most. So, through a culmination of all of the above, we decided that we had an obligation to do more.

Minding My Money Mondays & Tax Chit Chat

Minding My Money Mondays (#MMMM) was the YouTube series that was directly birthed following the events after Mr. Floyd’s death. In early December, we created a separate series called Tax Chit Chat (#TCC) that is for those looking specifically for just tax tips. All videos will ultimately get rolled into a much larger money management website (hopefully by early H2 of 2021), but in the interim, you can follow both series by subscribing to our YouTube channel. Each series has it’s own playlist and releases videos according to it’s prescribed schedule.

Video Episode Listing

Shown below is a listing of the episodes that were created through the date of this blog post. They go from most recent back to the very first episode. To catch an episode, simply click the title above the video thumbnail and you’ll be taken directly to it within YouTube. It’s our sincere hope that that you:

- Enjoy the videos and learn from them

- Spread the word on social media via the hashtags #MMMM and #TCC as we really hope to help people “Make My Money Make Sense!”

- Eventually join us on the money management website once it’s launched

- Send us questions and video suggestions at questions@makemymoneymakesense.com as we hope to help everyone learn how to better manage their money and avoid financial disaster (although NO ONE saw a Covid-19 type event coming).

3 Reasons People Are Broke! | MMMM S1 EP26

Top Year End Tax Saving Tips For 2020 | TCC S1 EP1

How Much To Contribute To Your 401K or Retirement Plan? | MMMM S1 EP25

How to save money buying a new car | MMMM S1 EP24

Move Out of Parents House After Graduating? | MMMM S1 EP23

Saving Money On A Tight Budget or Low Income| MMMM S1 EP22

Inherited $200K; Dealing With A Windfall| MMMM S1 EP21

Drain My Savings To Pay Off Debt? | MMMM S1 EP20

Wealth Is A Game of Emotions! | MMMM S1 EP19

Big Bank vs. Online Bank vs. Credit Union | MMMM S1 EP18

Tax Loss Harvesting Explained | MMMM S1 EP16

Student Loans: Pay Off or Pay For Life? | MMMM S1 EP15

Pay Off High Interest of High Balance Card First? | MMMM S1 EP14

Alternatives to low interest CDs | MMMM S1 EP13

5 ways to make $1,000! | MMMM S1 EP12

Broke? How to start an emergency fund from ZERO! | MMMM S1 EP11

Without these 2, you’ll never have money success! | MMMM S1 EP10

Poor money habits = profits for banks! | MMMM S1 EP9

Rockefeller on The Power of Interest | MMMM S1 EP8

IRS Guaranteed Installment Agreement | MMMM S1 EP7

I Can’t Pay The IRS; Now What? | MMMM S1 EP6

How To Get A 800+ Credit Score | MMMM S1 EP5

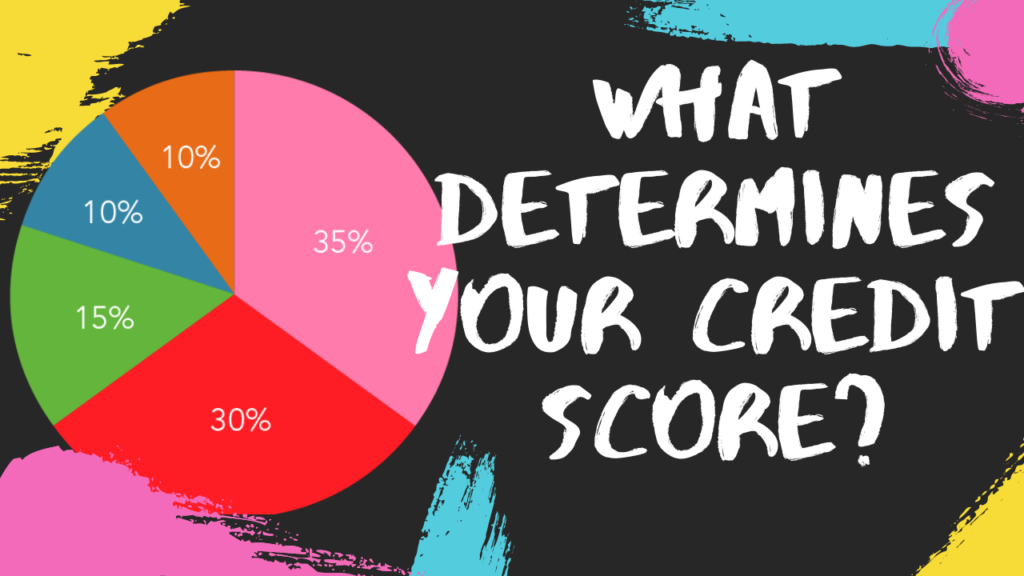

What Makes Up Your Credit Score? | MMMM S1 EP4

How Should You Manage Money? | MMMM S1 EP3

What Is A (Ideal) Budget? | MMMM S1 EP2

What is Money? | MMMM S1 EP1