Many self-employed taxpayers know that come tax time, they can receive a deduction if they pay for health insurance. However, what if you are “semi-retired” and your insurance comes in the form of Medicare? Can you take a deduction for the premiums you paid? Read on to find out!

Generally speaking, a taxpayer may be able to take this deduction if one of the following applies:

- They had a net profit from self-employment. You would report this on a Schedule C, Profit or Loss From Business, Schedule C-EZ, Net Profit From Business, or Schedule F, Profit or Loss From Farming.

- They had self-employment earnings as a partner reported to you on Schedule K-1 (Form 1065).

- They used an optional method to figure net earnings from self-employment on Schedule SE, Self-Employment Tax.

- They were paid wages reported on Form W-2 as a shareholder who owns more than two percent of the outstanding stock of an S corporation.

Before tax year 2010, Form 1040 instructions for line 29 stated, “Medicare premiums cannot be used to figure the [self-employed health insurance] deduction.” Likewise, before 2010, Publication 535, Business Expenses, stated that Medicare Part B premiums were not deductible as a business expense, in keeping with Field Service Advisory (FSA) 3042, issued in 1995.

However, in 2012 the Office of Chief Counsel advised IRS attorneys that self-employed individuals may deduct Medicare premiums from their self-employment income. Chief Counsel Advice (CCA) 201228037 clarified the IRS position that previously had appeared only in the instructions to Form 1040.

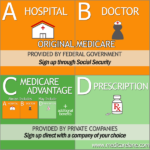

So what does this mean? Well, if you meet the requirements, Medicare premiums you voluntarily pay to obtain insurance in your name that is similar to qualifying private health insurance can be used to figure the deduction. This is applicable for all Medicare premiums (Parts A, B, C and D).

What if you paid premiums in the past but failed to take the deduction? You can amend your previously filed return (if you’re within the 3 year window) to refigure and claim the deduction. For more information, see Form 1040X, Amended US Individual Income Tax Return.