Most real estate investors have at least heard of the 1031 exchange, but very few have actually completed such a transaction. The 1031 exchange is a powerful tool to have in your creative real estate arsenal, as it allows you to dispose of one property and acquire another without paying capital gains tax on the property you are disposing of.

However, a 1031 exchange requires careful attention to the requirements, particularly as they relate to timing, in order to avoid potential ghoulish dealings with the IRS.

To start with, it is important to understand exactly what a 1031 exchange is. Named after the section of the Internal Revenue Code under which it resides, a 1031 exchange is the swap of one asset for another similar asset. In other words, in order to take advantage of this tax section, the type of property swapped must be of a similar “nature or character.” For example, livestock of different genders are not considered like-kind property.

Fortunately, this is not much of an issue with real estate, as the code allows for the exchange of any real property for any other real property. The property (generally) must be a business or investment asset, meaning the property generates revenue or helps in generating revenue. Typically, these properties will be warehouses, offices or rental homes. Primary residences and other property that do not generate regular income do not qualify, such as a second home or vacation home.

Properties located inside and outside the country cannot be exchanged for each other. Also, real property cannot be exchanged for personal property, such as a house for farm equipment. Lastly, personal residences are not eligible for like-kind exchanges; the property must have been an investment or business property to qualify.

One of the nicest features of the rule is that the properties do not have to be of similar “grade or quality.” In other words, it’s perfectly legitimate to exchange a house in much need of repairs for a property that is in pristine condition. The like-kind exchange is an ideal vehicle for trading up properties without paying capital gains taxes.

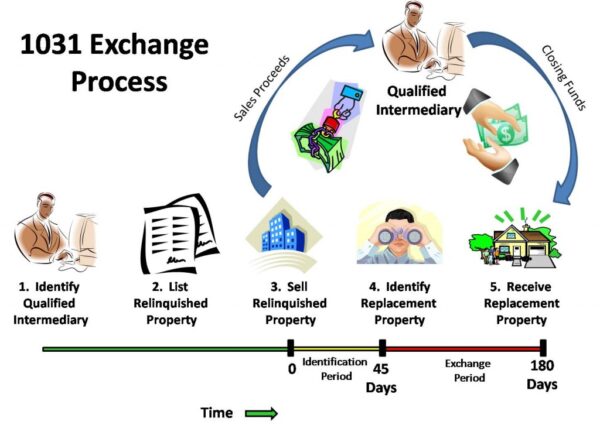

Timing is a key element to a successful 1031 exchange. In order to qualify for the capital gains deferral, the decision to treat a property sale as part of a 1031 exchange needs to be made before the closing date of the sale of that property. Then, the seller must identify the property to be acquired in the exchange within 45 days of the closing date of the sold property. The new property must then be acquired within 180 days of the date that the prior property was sold.

The 1031 Exchange Explained Visually

When it comes to identifying the replacement property, there are some interesting rules, and you can pick which rule you want to follow. The property needs to be of equal or greater value, but you can select multiple properties as potential properties to buy, subject to the following rules:

1. You can select up to three distinct properties as possible replacement properties for the exchange, regardless of their value, OR…

2. You can select any number of properties, as long as their total fair market value does not exceed double the value of the property you sold, OR…

3. You can select any number of potential properties to buy, as long as the fair market value of the property you eventually close on within the 180 day window is at least 95% of the value of the property you sold.

In order to protect the “integrity” of the like-kind exchange, the IRS requires that you use a qualified intermediary in order to complete the transaction and qualify for the capital gains exclusion. The qualified intermediary escrows the proceeds from the sale of the first property, and ensures that the funds are only used to acquire a like-kind property.

The qualified intermediary works with your title company, escrow company, or closing attorney to facilitate the transaction. The key element of this part of the transaction is to ensure that you never actually obtain receipt of the funds from the property sold, and there is no record of it passing through your own personal accounts.

Normally when an investment property is sold, you must recapture the sum total of the depreciation you have claimed on the property. In other words, your taxable capital gains include not only the actual appreciation in the property’s value, but also the amount that you deducted as depreciation over the time you owned.

A beautiful benefit of the 1031 exchange is that there is no depreciation recapture required. Instead, the accumulated depreciation in the old property affects your basis in the new property you are buying in the exchange.

Since the purpose of the like-kind exchange is to avoid paying capital gains tax on appreciation of properties, there is no benefit to using a 1031 exchange on a property on which you have a loss. By selling a property for a loss, a portion of that loss becomes deductible. The 1031 exchange rules do not recognize losses as an adjustment to the basis in the newly acquired property, so there is no benefit in using this vehicle for that purpose.

Our hope is that this article has provided you with enough information to make the decision of when to use the 1031 exchange rules to your benefit. As with all things, however, be sure to consult with a licensed tax professional for advice regarding your specific transaction, and remember that you must use a Qualified Intermediary in order to complete the transaction.

Are you are thinking of disposing of your property and have questions? Why not give us a call? We are here to help, and only a phone call away!

Related articles

- Keys Rules For Section 1031 Exchanges (harp-onthis.com)